Canadian Manganese Announces Updated Mineral Resources Estimate for Plymouth Deposit at Woodstock Including M&I Resource of 56,700,000 tonnes grading 10.07% Manganese

Toronto, March 3, 2023 – Canadian Manganese Company Inc. (“CDMN” or the “Company”) (NEO: CDMN) is pleased to report the results of an updated independent, pit-constrained, Mineral Resource Estimate (the “MRE”) on the Plymouth manganese-iron deposit (“Plymouth Deposit”) at the Company’s wholly owned Woodstock Project in New Brunswick, Canada.

Highlights:

- Measured and Indicated Resources of 56.7 million tonnes at Manganese (Mn) grade of 10.07%

- Inferred Resource of 17.7 million tonnes at Mn grade of 10.02%

- Tonnage of Measured and Indicated Resources exceeds previous MRE (November 2021) total tonnage by 32% at comparable Mn grades

- 73% increase in total MRE tonnage (all categories) vs. 2021 at comparable Mn grades

- Continuity and consistency of deposit grade and spatial aspects support high resource category conversion percentage and expansion of deposit’s economic potential

The 2023 MRE was prepared by Mercator Geological Services Limited in accordance with Canadian Securities Administrators’ National Instrument 43-101 (NI 43-101) and the 2014 CIM Standards and includes results of the Company’s most recent (2021-2022) deposit delineation drilling program. This drilling program was specifically designed to infill on previous drilling to maximize conversion of 2021 Inferred Mineral Resources to Measured and Indicated status in the 2023 MRE. It also included several resource expansion drill holes that targeted down-dip extensions of the central deposit area, where greatest modelled thicknesses of mineralization grading above 5% Mn occur.

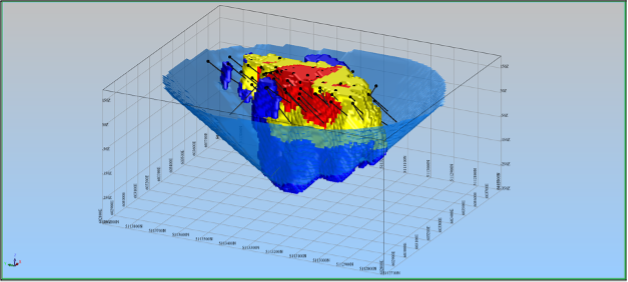

Drilling program results (see Company new releases dated May 10, 2022 and August 11, 2022) confirm the robust nature of the current MRE deposit model and support the high conversion percentage of 2021 Inferred Mineral Resources to Indicated and Measured categories in 2023. The associated resource expansion holes confirm the down-dip extension of the main mineralized zone’s central area and account for most of the overall increase in total deposit tonnage seen in the 2023 MRE. Much of this new tonnage is classified in the Inferred category. Figure 1 below presents an isometric view looking northeast of the deposit block model showing color-coded resource categories within the MRE pit shell.

Matthew Allas, President and CEO commented,

“Today’s results reflect the excellent work by our team of professionals and the support received from local community members, who have either assisted with our efforts or been directly affected by our programs. Their combined efforts have allowed us to complete a very impactful MRE updating and expansion program. The updated MRE highlights the Plymouth Deposit’s scale and continuity, further confirming our view of its global significance. We are continuing our work on de-risking the project through environmental and technical studies that will form the foundation for our permit applications.”

The updated 2023 MRE is presented in the table below.

Plymouth Manganese-Iron Deposit Mineral Resource Estimate – Effective Date March 1, 2023

| Type | Mn % Cut-off | Category | Rounded Tonnes | Mn % | Fe % |

| Pit Constrained | 4.75 | Measured | 28,800,000 | 10.38 | 14.45 |

| Pit Constrained | 4.75 | Indicated | 27,900,000 | 9.74 | 13.55 |

| Pit Constrained | 4.75 | Measure and Indicated | 56,700,000 | 10.07 | 14.01 |

| Pit Constrained | 4.75 | Inferred | 17,700,000 | 10.02 | 13.62 |

Notes:

1) Mineral Resources were prepared in accordance with the CIM Standards (2014) and CIM MRMR Best Practice Guidelines (2019).

2) Mineral Resources are defined within an optimized conceptual pit shell with average pit slope angles of 45⁰ in bedrock and 20⁰ in overburden; a 3.78 :1 waste to mineralized material ratio applies

3) Pit optimization parameters include: pricing of US$1,760 (CA$2,288)/t Mn in High Purity Manganese Sulphate Monohydrate (HPMSM) containing 32% Mn, a currency exchange rate of CA$1.30 to US$1.00, mining at US$5.50 (CA$7.15)/t, a 2.5% gross metal royalty, combined processing and G&A cost (1,500 t/d process rate) at US$199.17 (CA$258.92)/t processed, and overall Mn recovery to HPMSM of 77%. Fe content did not contribute to the pit optimization process.

4) Mineral Resources are reported at a cut-off grade of 4.75% Mn within the optimized pit shell. This cut-off grade reflects the marginal cut-off grade used in pit optimization to define Reasonable Prospects for Eventual Economic Extraction using open pit mining methods.

5) Mineral Resources were estimated using GEOVIA Surpac® 2021 (Surpac) software and Ordinary Kriging methods applied to 3 m downhole assay composites. No grade capping was applied. Model block size is 10 m x 10 m x 10 m with partial percent volume estimation applied.

6) Bulk density was estimated using Ordinary Kriging methods applied to drill core specific gravity data; it is assumed that specific gravity approximates bulk density for the materials modelled. The average deposit bulk density for Mineral Resources is 3.13 g/cm3.

7) Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues

8) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

9) Mineral Resource tonnages are rounded to the nearest 10,000.

Sensitivity of the 2023 MRE to cut-off grade is tabulated below. Results show that deposit tonnages and grades do not vary dramatically within the cut-off range assessed. This is interpreted to be a reflection of both grade uniformity within the deposit and sharp grade boundaries at deposit limits. Iron (Fe) content reflected in the MRE shows comparable contact and distribution characteristics to Mn and is reported due to potential for future by-product value additional to Mn production. It does not contribute to the current MRE pit optimization.

Plymouth Deposit Cut-off Grade Sensitivity Analysis for 2023 Mineral Resources

| Type | Mn % Cut-off | Category | Rounded Tonnes | Mn % | Fe % |

| *Pit Constrained | 4.75 | Measured | 28,800,000 | 10.38 | 14.45 |

| Pit Constrained | 4.75 | Indicated | 27,900,000 | 9.74 | 13.55 |

| Pit Constrained | 4.75 | Measured and Indicated | 56,700,000 | 10.07 | 14.01 |

| Pit Constrained | 4.75 | Inferred | 17,700,000 | 10.02 | 13.62 |

| Pit Constrained | 6.00 | Measured | 28,300,000 | 10.48 | 14.56 |

| Pit Constrained | 6.00 | Indicated | 26,600,000 | 9.95 | 13.74 |

| Pit Constrained | 6.00 | Measured and Indicated | 54,900,000 | 10.22 | 14.16 |

| Pit Constrained | 6.00 | Inferred | 17,300,000 | 10.13 | 13.72 |

| Pit Constrained | 7.25 | Measured | 27,000,000 | 10.66 | 14.78 |

| Pit Constrained | 7.25 | Indicated | 24,200,000 | 10.28 | 14.07 |

| Pit Constrained | 7.25 | Measured and Indicated | 51,200,000 | 10.48 | 14.44 |

| Pit Constrained | 7.25 | Inferred | 14,600,000 | 10.78 | 14.41 |

| Pit Constrained | 8.50 | Measured | 24,300,000 | 10.96 | 15.15 |

| Pit Constrained | 8.50 | Indicated | 20,500,000 | 10.70 | 14.47 |

| Pit Constrained | 8.50 | Measured and Indicated | 44,800,000 | 10.84 | 14.84 |

| Pit Constrained | 8.50 | Inferred | 13,400,000 | 11.04 | 14.69 |

*Notes:

This table shows sensitivity of the March 1, 2023 MRE to cut-off grade. The base cut-off value of 4.75% Mn is bolded for reference and defines the 2023 MRE reporting cut-off grade.

Figure 1: Isometric view to northeast showing 2023 MRE block model with constraining pit shell, drill hole traces, and color-coded MRE categories (Red=Measured, Yellow=Indicated, Blue=Inferred)

QUALIFIED PERSONS

The scientific and technical information contained in this news release has been reviewed and approved by Paul Moore, P. Geo. (NB), the Company’s designated, non-independent Qualified Person within the context of NI 43-101. Matthew Harrington, P. Geo., (NB) of Mercator Geological Services Limited is the independent Qualified Person within the context of NI 43-101 who is responsible for preparation of the 2023 MRE disclosed in this press release.

About Canadian Manganese

CDMN is a Canadian mineral development company aiming to become a supplier of high-purity manganese metal products for the rechargeable battery industry. CDMN holds the Woodstock Project in New Brunswick.

For further information:

Matthew Allas

President and CEO

+1 647 338 3748

The NEO Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy of this release.

Additional information on CDMN is available at www.CanadianManganese.com.

Notice regarding forward-looking statements:

This news release includes forward-looking statements regarding CDMN, and its respective businesses, which may include, but are not limited to, statements with respect to the timing of additional assay results and the ability to provide a Mineral Reserve, the expected plan to become a supplier of high-quality manganese metal products. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Such statements are based on the current expectations of the management of each entity. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections, or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited, risks regarding the mining industry, economic factors, the equity markets generally, risks associated with growth and competition as well as those risks and uncertainties identified and reported in the Company’s public filings under its SEDAR profile at www.sedar.com. Although CDMN has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and CDMN undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.