Global HPMSM Market

By looking at how the global end use sectors for lithium-ion batteries will change in the coming years, it is important to provide context for HPMSM demand. Demand for lithium-ion batteries in relation to power capacity is projected to grow from its capacity of 279 GWh in 2020 to 2,139 GWh in 2030. This demonstrates remarkable 22.6% annual growth rate. Lithium-ion batteries are currently widely used in portable electronics such as mobile phones and laptops; however, their high energy density makes them ideal for use in the surging EV market, this constitutes by far their largest absolute growth driver.

The transition to EV’s are based on 3 key factors

- Environmental: The world, including governments and consumers are demanding a reduction in Green House Gas emissions that are leading to climate change and/or air pollution. Because of these demands, this is leading to subsidies, targets and quotas being announced across the globe to incentivise and require the transition from fossil fuels to carbon-free transportation.

- Economic: EVs have fewer moving parts than that of an Internal combustion engine. It is estimated that an EV has 100 moving parts compared to 400 that are associated with an internal combustion engine and EV’s are generally easier to maintain and repair. Their power source is considerably cheaper than petrol or diesel, and much more convenient being able to charge from home, as well with the increasing scale of production and technological advancements, battery costs continue to fall each year, steadily advancing EV purchase prices below equivalent internal combustion engines

- Performance: Battery technologies are constantly improving and creating more range for consumers to be more in line with traditional vehicles, diminishing ‘range anxiety’. As the range reaches equilibrium, consumers are finding that EVs can offer a better driving experience with quicker acceleration, a smoother ride due to no shifting of gears, and less maintenance required.

Moving forward, forecasts for all EV sales are to rise from just 6.7 million units per annum in 2020 to exceed 42M by 2030, initially with 34% (2.2 million units per year) of this total constituting BEVs, rising to 60% (25.4M per year). The growth rate of all EVs is therefore 20.3% per annum over this period (Source: CRU Group)

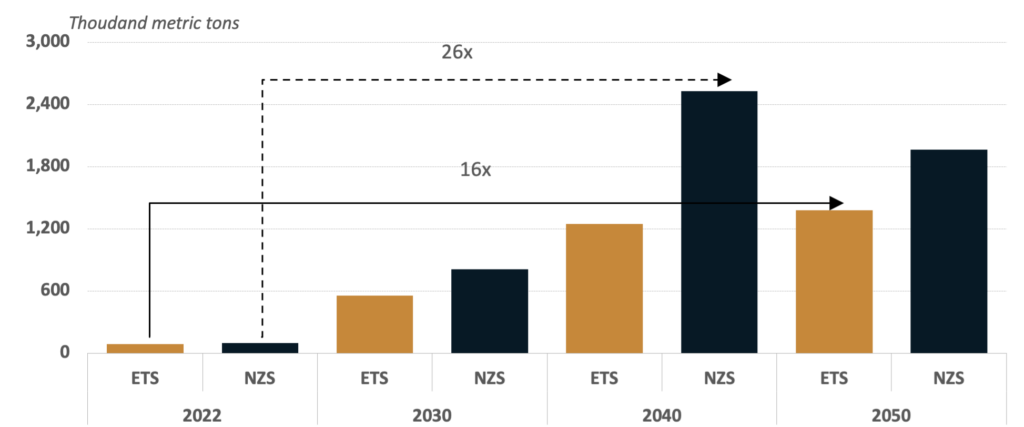

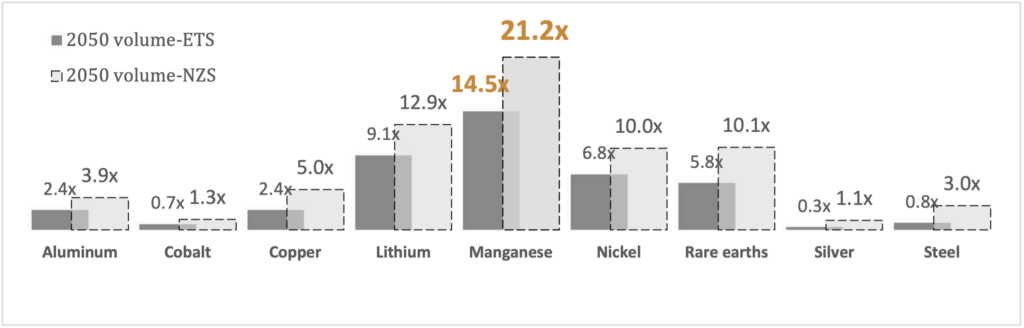

The Economic Transition Scenario is a Bloomberg NEF baseline assessment of how the energy transition might evolve from today as a result of cost-based technology changes.

The Net Zero Scenario describes an economics-led evolution of the energy economy to achieve net-zero emissions in 2050. This scenario combines faster and greater deployment of renewables, nuclear and other low carbon dispatchable technologies in power with the uptake of cleaner fuels in end-use sectors, most notably hydrogen and bioenergy. Taking a sector-led approach, it describes a credible pathway to meet the goals of the Paris Agreement.

Note: Energy transition includes power generation, battery storage, power grids and transport sectors. Prices in 2050 assumed to be the average of the last 10 years. Nominal dollar value in 2050 is discounted by a 2.75% annual rate. This is in line with the average rates for major economies where demand is concentrated

Source: BloombergNEF

Although demand growth scenarios over the next decade are compelling, forecast manganese demand required to meet the global decarbonization objectives truly highlight the need for “generational” supply security

Forecast Manganese Demand from EV Batteries