North American Battery Growth

The Inflation Reduction Act (IRA) has injected at least $369 billion into the U.S. clean energy economy

- Advanced Manufacturing Production Credit and Clean Vehicle Credit introduced credits to support the domestic supply chain, from raw materials to battery cells, modules, EVs and energy storage

- Bloomberg NEF estimates at least $80 billion will be committed to the North American battery supply chain in 2023 with additional guidance expected in March 2023

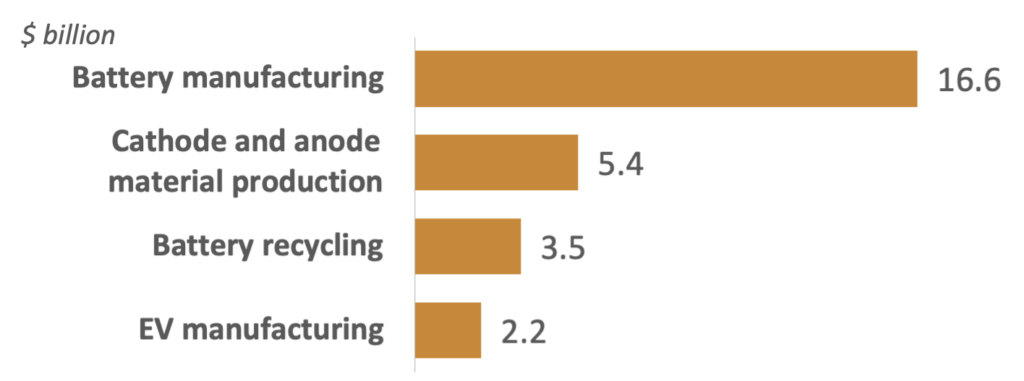

- Post-IRA investment commitments in the North American EV supply chain from automakers and battery manufacturers have reached ~$28 billion as at December 2022

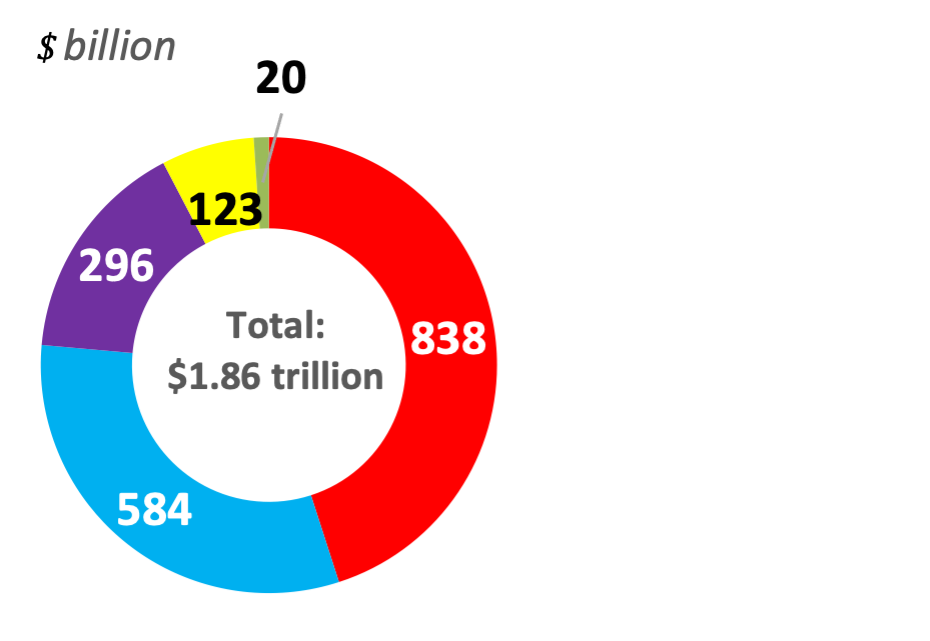

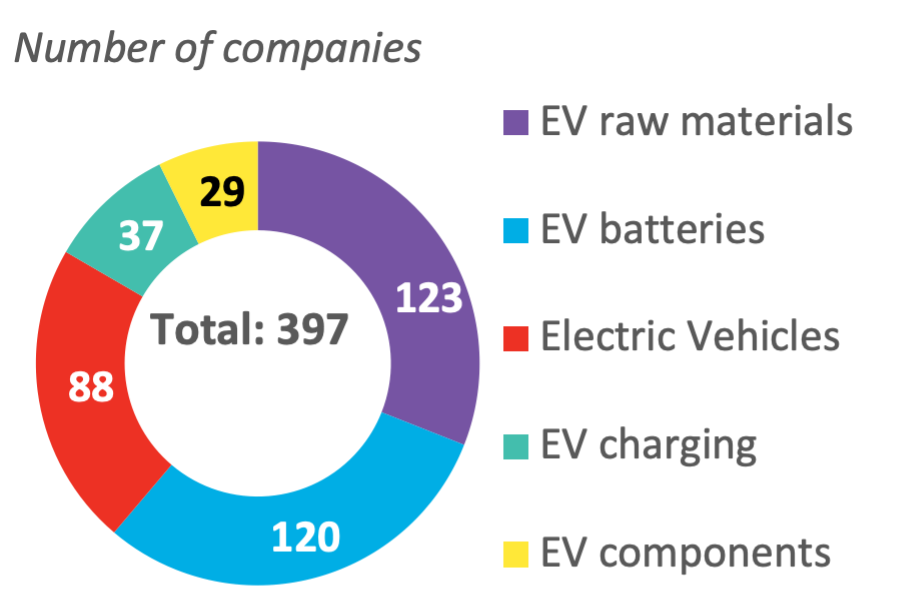

BloombergNEF has been tracking public market EV equities since 2010, as this sector has grown from 61 companies ($156.2 billion) to 397 ($1.86 trillion) as at Dec 31st, 2022 (charts below)

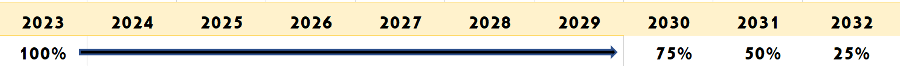

North American government growth initiatives have created a “gold rush” of opportunities throughout the battery supply chain. The production tax credits for US-based manufacturing of battery electrode active materials, cells and modules drop to 75% of the value if they are sold during the calendar year 2030, and subsequently to 50% in 2031 and 25% in 2032 before being phased out at the end of 2032

Production tax credits timeline for battery electrode active materials, cells and modules

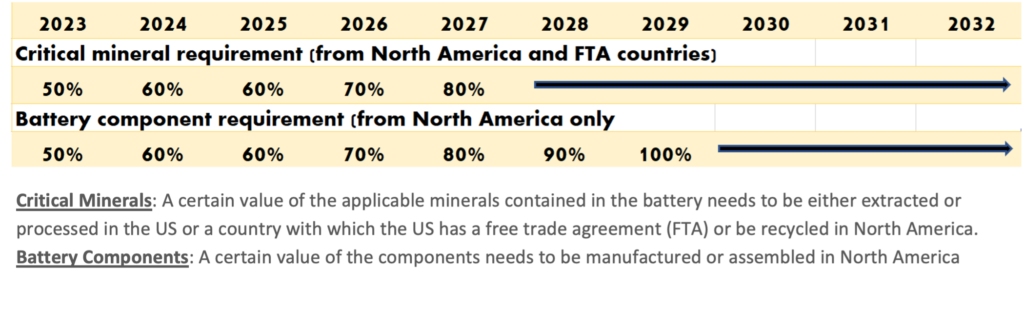

Requirements to access EV tax credit

Government actions are attracting significant long-term manufacturing investment – Canada has initially allocated ~$2.8 billion directed to research and project development

Industry is in its infancy, requiring supply chain development

Importance of securing manganese supply is clear based on its inclusion in the announced cell manufacturing capacity

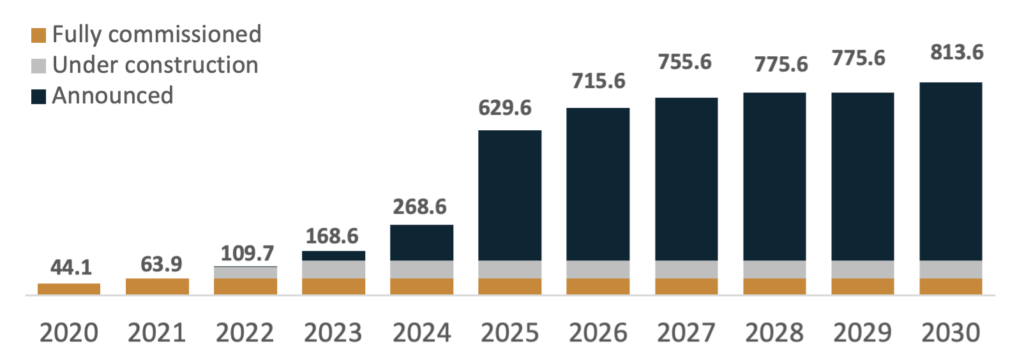

Cell Manufacturing Capacity in North America (Gw)

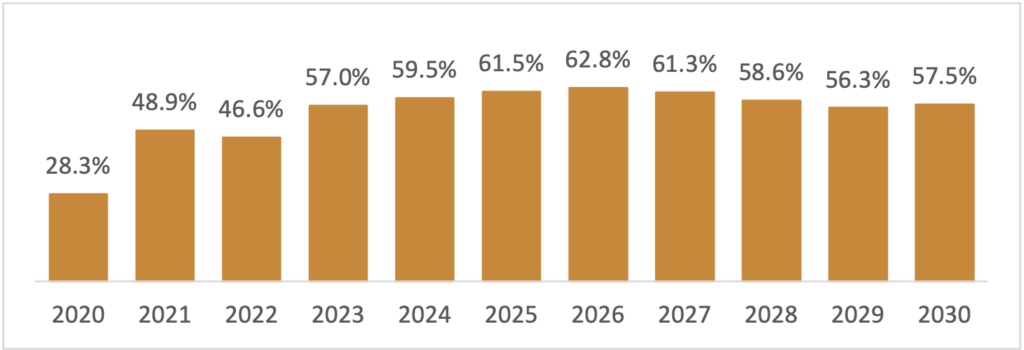

Forecast U.S. Battery Production Using Manganese Based Chemistry

Source: BloombergNEF

Power Grid Long-Term Outlook

Between 2020 and 2050, the market for energy storage projects offering transmission and distribution (T&D) services is estimated to be around $277 billion, which accounts for 2% of the projected $14 trillion in cumulative grid investment during the same period. The use of batteries for network support is still in its early stages, and it is expected to take more than ten years for energy storage T&D services to reach a $10 billion per year market based on lithium-ion battery system and grid prices. However, it is unlikely that energy storage will disrupt traditional T&D investment based on expected future battery costs.

Energy storage systems are capable of providing various T&D services, such as congestion and voltage control. These systems can charge during times of excess power capacity and discharge during periods of congestion, thus deferring the need for grid investment. In addition, smart inverters can be used alongside battery storage to regulate voltages and improve power system stability and reliability.

As battery costs decline, energy storage projects will become more competitive relative to grid projects over time. It is anticipated that the cost of a four-hour duration lithium-ion battery system will drop by 68% to $104/kWh from the end of 2020’s $320/kWh.

APAC and EMEA are expected to be the key markets where this trend will be more pronounced, including countries like the U.K., France, Germany, Australia, and China. Grid operators have proposed virtual transmission line projects in Germany (“Netzbooster”) and France (“Project RINGO”), where a battery system would address congestion and reduce the need for additional network infrastructure. Battery storage projects are more competitive than grid projects in scenarios where supportive regulatory structures exist, market mechanisms reward batteries for providing grid services, high network reinforcement costs are incurred due to rough terrain and sparse network topology, and where there is a low but non-zero demand growth rate that creates constraints that battery storage projects can defer for several years.

Resilience

Resilience in the context of power systems refers to their ability to withstand or quickly recover from major unexpected power failures. As utilities consider options for future projects, the effects of climate change make grid resilience an important consideration. This will bias investments in favor of customer-sited resources, underground cables, digitalization for rapid assessment and recovery, and black-start capable mini-grids. Countries often use a combination of these approaches to improve grid resilience.

It is likely that transmission and distribution power lines will be underground in the future. This is due to the need to improve grid resilience, as well as achieve public acceptance.

Small-scale solar and demand-side flexibility can improve resilience and reduce peak demand for residential, commercial, and industrial customers. This, in turn, reduces the amount of traditional grid investment needed to meet growing peak loads. We estimate that demand-side flexibility could avoid around $840 billion in investment between 2020 and 2050, which is equivalent to 6% of the grid investment outlook. However, networks will need enhanced visibility, control, and automation to enable these types of solutions, which will offset some of the savings from avoided network assets.

Emerging economies will continue to deploy additional transmission and distribution assets over time, although some will turn to solar home systems and mini-grids. The conventional approach of deploying transmission and distribution grids in emerging markets is highly subsidized, but too expensive for many governments. This prompts them to look at decentralized energy options as a way to achieve universal electricity access with a reasonable standard of reliability.

Around 238 million households need to gain electricity access over the next decade in Sub-Saharan Africa, Asia, and island nations to achieve universal access. Mini-grids can serve almost half of these, particularly in low- and medium-density areas with low-income families. Over time, isolated grids may begin to interconnect and expand as population densities and energy intensities rise, resembling a more traditional meshed power network. Mini-grids that evolve into interconnected systems are unique because they have an inherent fall-back should grid supply be lost.

Climate Targets

According to our baseline Economic Transition Scenario, the world is expected to experience a 2.2°C global warming by 2050.

However, our NEO Climate Scenario (NCS) investigates an alternative pathway that meets an emissions budget well below two degrees. In the NCS, we assume a faster uptake of direct electrification in transport, buildings, and industry, which results in a 63% increase in global electricity demand compared to the Economic Transition Scenario. We also enforce the electricity sector to meet an assigned emissions budget by deploying additional wind, PV, and batteries, as well as hydrogen-fueled gas turbines from 2030. By 2050, wind, PV, and hydrogen-fired power plants would provide 45%, 30%, and 13% of global electricity, respectively.

To achieve this, investment in grid infrastructure would double to $28.7 trillion over the next 30 years, an additional $14.7 trillion compared to the Economic Transition Scenario. This would lead to a tripling in renewable capacity additions and a 2.7-times increase in investments in new connections and network reinforcements. The number of annual generator connection projects would increase fivefold, while investments in network replacements would only be 8% larger than the baseline scenario since investments in new connections and reinforcements would only require replacement further down the track.

However, permitting and public acceptance will pose challenges due to the scale of grid development required in this scenario. For instance, about 5 million kilometers of transmission and distribution grid would need to be added between 2020 and 2050 in Europe under the NCS, compared to 3 million kilometers under the Economic Transition Scenario. Policies that facilitate and expedite the permitting of network projects will need to accompany renewable energy mandates to ensure this level of grid development is possible.

To prevent the grid from becoming a bottleneck, technologies that avoid building new power lines or minimize their footprint will play a crucial role. These include digital substations, behind-the-meter generation, energy storage, high capacity conductors, and flexible AC transmission systems.

Source: BloombergNEF