Canadian Manganese provides update on Royalty Financing and Announces results of Annual and Special Meeting of Shareholders and appointment of New Board Chair

Toronto, November 15, 2024 – Canadian Manganese Company Inc. (“CDMN” or the “Company”) (CBOE CA: CDMN) is pleased to provide an update on the status of its previously announced gross revenue royalty and announce the results of voting at its annual general and special meeting of shareholders which was held on June 25, 2024 (the “Meeting”). Full details of all the voting results for the 2024 Meeting are available on SEDAR+ at www.sedarplus.ca.

UPDATE ON ROYALTY FINANCING

On April 2, 2024, the Company agreed to grant a gross revenue royalty (“GRR”) on the Woodstock Project to Leventis Capital Pte Ltd. (“Leventis”). The Company initially contemplated the purchase by Leventis of a 3% GRR in one transaction for US$15,000,000, which was subsequently amended to two tranches whereby Leventis would first purchase a 1.5% GRR for US$7,500,000 and then purchase an additional 1.5% GRR for US$7,500,000 at a later date. The Company and Leventis have now agreed that the royalty will be completed in one single transaction of a 2% GRR for US$10,000,000.

GRR Repurchase Terms

CDMN will have the option to buy back the 2% GRR at any time by paying Leventis US$15,000,000. To preserve the option, an additional cash payment will be made by CDMN to Leventis, if the option is not exercised on or before November 30, 2027, and each three-year anniversary of such date. The amount of the payment to be made will be calculated based on a formula that provides notional interest on the purchase price at a rate of 10% per annum.

If the option is not exercised on or before November 30, 2027, the payment that would be owing to preserve the option is US$3,310,000, payable by March 30, 2028. If the option is not exercised on or before November 30, 2030, the payment that would be owing to preserve the option would be a further US$4,405,610, payable by March 30, 2031. The payments due each third March 30 to preserve the option will continue to be payable until the option is exercised. If the payments are not made, CDMN would lose the option to repurchase the GRR for US$15,000,000.

Full details of the GRR and the formula for the foregoing option payments will be available in the royalty agreement, a copy of which will be filed under the Company’s profile on SEDAR+ at www.sedarplus.ca following completion of the sale of the GRR.

Closing of the 2% GRR for US$10,000,000 is now expected to occur by November 28, 2024. The Company intends to repay its outstanding $5,000,000 principal senior secured convertible debenture, as well as accrued interest and early repayment fees, immediately upon closing of the above gross revenue royalty.

AGM RESULTS AND APPOINTMENT OF NEW BOARD CHAIR

A total of 56,916,474 common shares, representing 38.96% of the votes attached to all outstanding shares as at the record date for the Meeting, were represented at the Meeting.

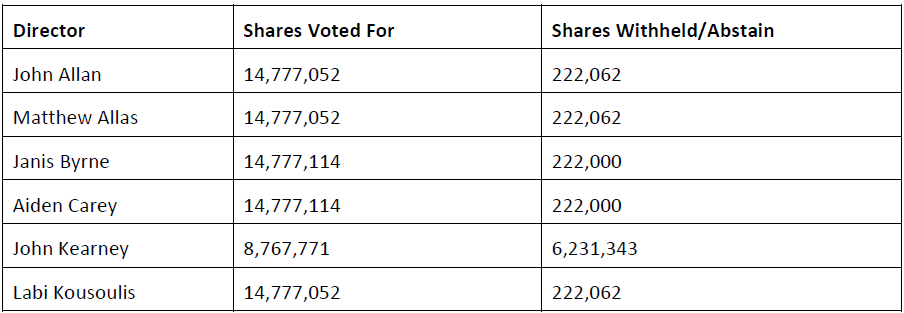

The nominees for directors were elected as set out in the following table:

The Chairman of the Meeting, John Kearney, disallowed proxies representing 41,907,114 common shares. Such proxies were WITHHELD from voting in respect of Mr. Kearney’s election as a director but were voted FOR the election of all other nominees. Mr. Kearney disallowed such proxies based on his sole determination as Chairman of the Meeting and based upon his own personal legal advice that they were illegally solicited by certain Directors and others acting as a group. This determination to disallow these proxies was made by Mr. Kearney despite the objections of Matthew Allas, CEO and Director who was in attendance at the Meeting.

At the Meeting, shareholders also approved (i) the Company’s Stock Option Plan as amended to increase the number of common shares reserved for issuance from 10% to 20% of the outstanding common shares from time to time, (ii) all unallocated options under the option plan, (iii) the re-appointment of McGovern Hurley LLP as auditors of the Company for the ensuing year, (iv) the approval of the Company’s restricted share unit plan as amended to increase the number of common shares reserved for issuance from 3% to 5% of the outstanding common shares from time to time and (v) the amendment of the terms of 333,333 common share purchase warrants exercisable at $0.27 per share to extend the expiry date from April 29, 2024 to April 29, 2027.

Appointment of a New Chairman

The Company also announced that on July 4, 2024, the board of directors appointed John Allan as the Chair of the Board of Directors. John Kearney continues as a director.

ABOUT CANADIAN MANGANESE

CDMN is a Canadian critical mineral development company aiming to become a supplier of high-purity manganese metal products for the rechargeable battery industry. CDMN holds the Woodstock Project in New Brunswick.

For further information:

[email protected]

www.CanadianManganese.com

Matthew Allas: President and CEO +1 647 338 3748

Cboe Canada has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy of this release.

Notice regarding forward-looking statements:

This news release includes forward-looking statements regarding CDMN, and its business, which may include, but are not limited to, the timing of closing of the royalty sale, the repayment of the Company’s outstanding debentures and the Company’s business plans. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “is expected”, “expects”, “scheduled”, “intends”, “contemplates”, “anticipates”, “believes”, “proposes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Such statements are based on the current expectations of the management of each entity. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections, or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include, but are not limited to, risks regarding the mining industry, economic factors, the equity markets generally, risks associated with growth and competition as well as those risks and uncertainties identified and reported in the Company’s public filings under its SEDAR+ profile at www.sedarplus.ca. Although CDMN has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and CDMN undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.